Welcome to BrightMoon Capital Pvt. Ltd.

Our objective is to provide superior financial results to our clients. Over a medium to long time period, the results from our advisory services should be far better than provided by private banks. The returns should be better than the benchmarks i.e. sensex or crisil bond index (of course after the cost).

Investment Growth

Maximize your returns with our expert guidance

Portfolio Management

Diversified strategies for optimal results

Secure Investments

Risk-managed approach to wealth building

Our Products & Services

Mutual Funds

Diversified investment solutions for long-term wealth creation

Learn MoreDebentures

Fixed income securities with attractive yields

Learn MoreStructured Products

Customized investment products for specific risk-return profiles

Learn MorePMS

Portfolio Management Services for high net worth individuals

Learn MoreFixed Deposits

Secure deposit schemes with guaranteed returns

Learn MoreBonds

Government and corporate bonds for stable income

Learn MoreWe offer a comprehensive range of investment products and services tailored to meet your financial goals. Our expert team provides personalized advice to help you make informed investment decisions.

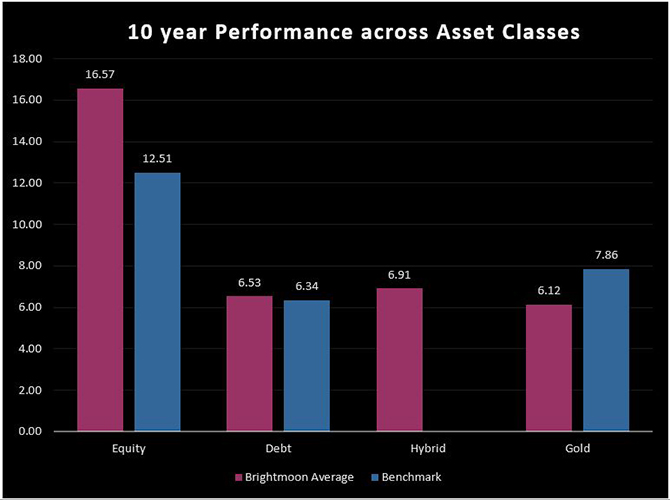

Performance Chart

The data shows the average return generated by Bright Moon Capital vis-a-vis the benchmark. Nippon India Index Fund Nifty Fifty plan is considered as the benchmark for Equity sector, Category Average of Bond Fund for Debt, Category Average of Gold Fund for Gold.

As can be comprehended, return generated by Bright Moon for Equity is 16.57% p.a. against Benchmark of 12.51% p.a, for Debt is 6.53% p.a against benchmark of 6.34% p.a and Gold is 6.12% p.a against Benchmark of 7.86% p.a.

Hybrid being a vast sector doesn't have any benchmark of its own. The return generated for Hybrid sector is 6.91% p.a.

Investment Calculator

Make informed investment decisions with our comprehensive financial calculator